How can we develop a rewards program relevant to insurance company customers and be a differentiator in the current ecosystem

ABOUT

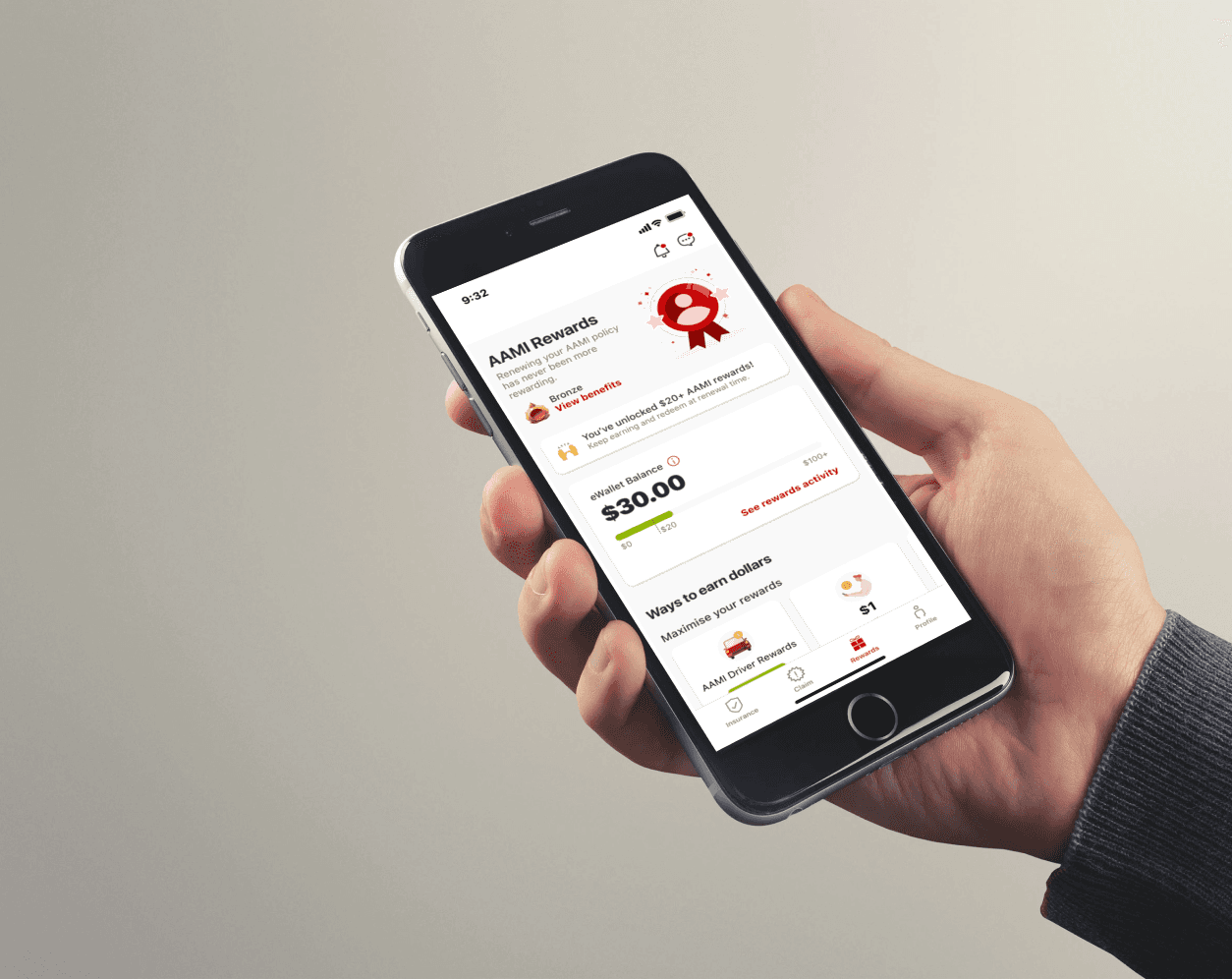

The business is looking to build a loyalty & rewards program for customers. The program hopes to build an ongoing value & benefits for customers, whilst ensuring the business focus on retention & risk reduction. We were approach by the business to create a vision for the new loyalty and rewards program

RESULT

Business took our design and feature proposal out to market to look for potential vendors , saved costs in hiring external agencies to develop the vision of the app.

01

DISCOVER & DEFINE

The team & my role

Timeline

3 months full-time

Business objective

Let's talk about the high level business objective for Suncorp rewards program :

Improve & increase Customer Retention during renewals period

Establish competitive advantage in the market to attract potential customers and enhance brand loyalty

Designer's goals

The designers' goals were :

Create a loyalty program that is more in-line with insurance

Integrate existing infrastructure and program to the vision

02

RESEARCH

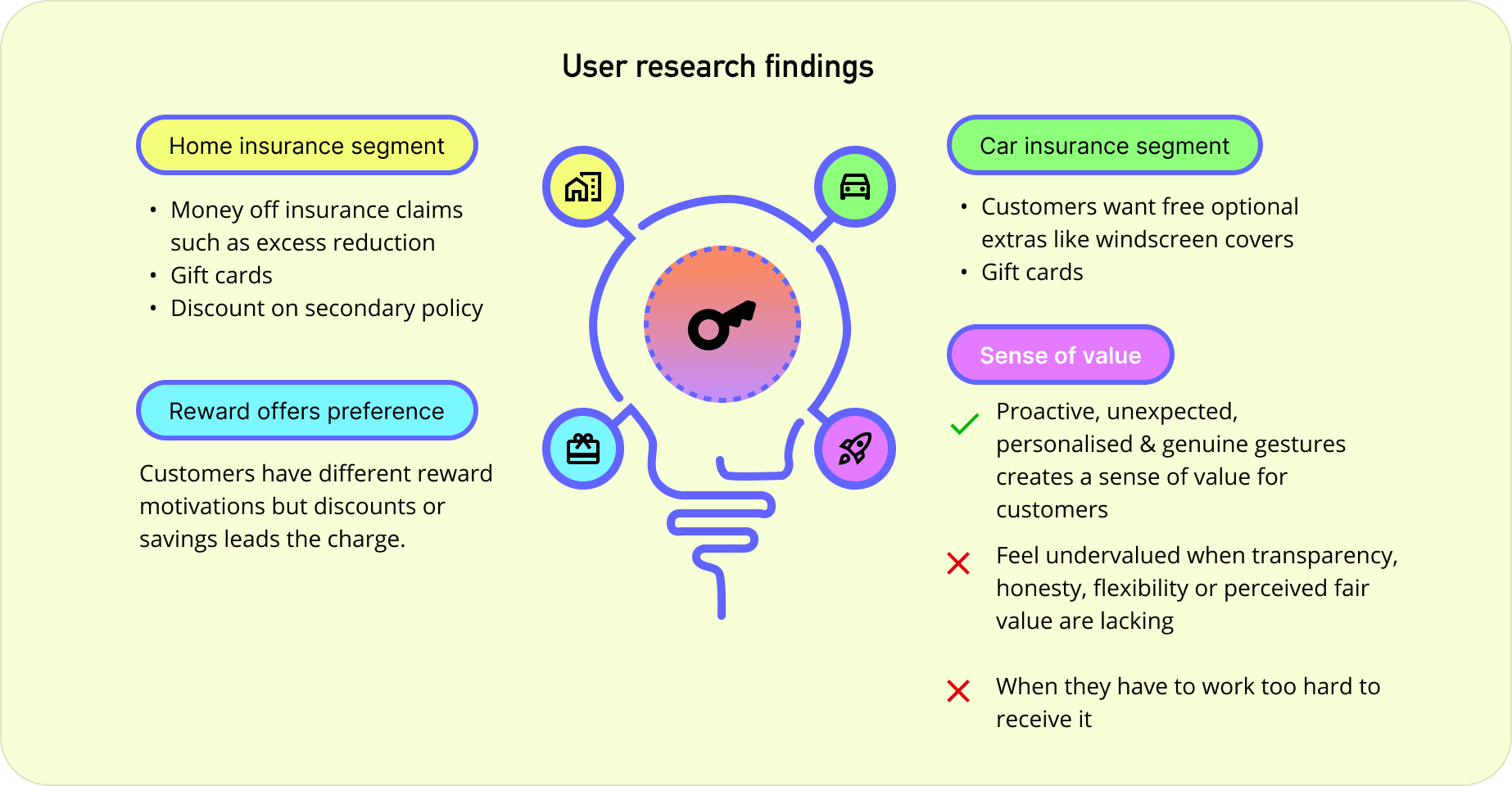

User research findings

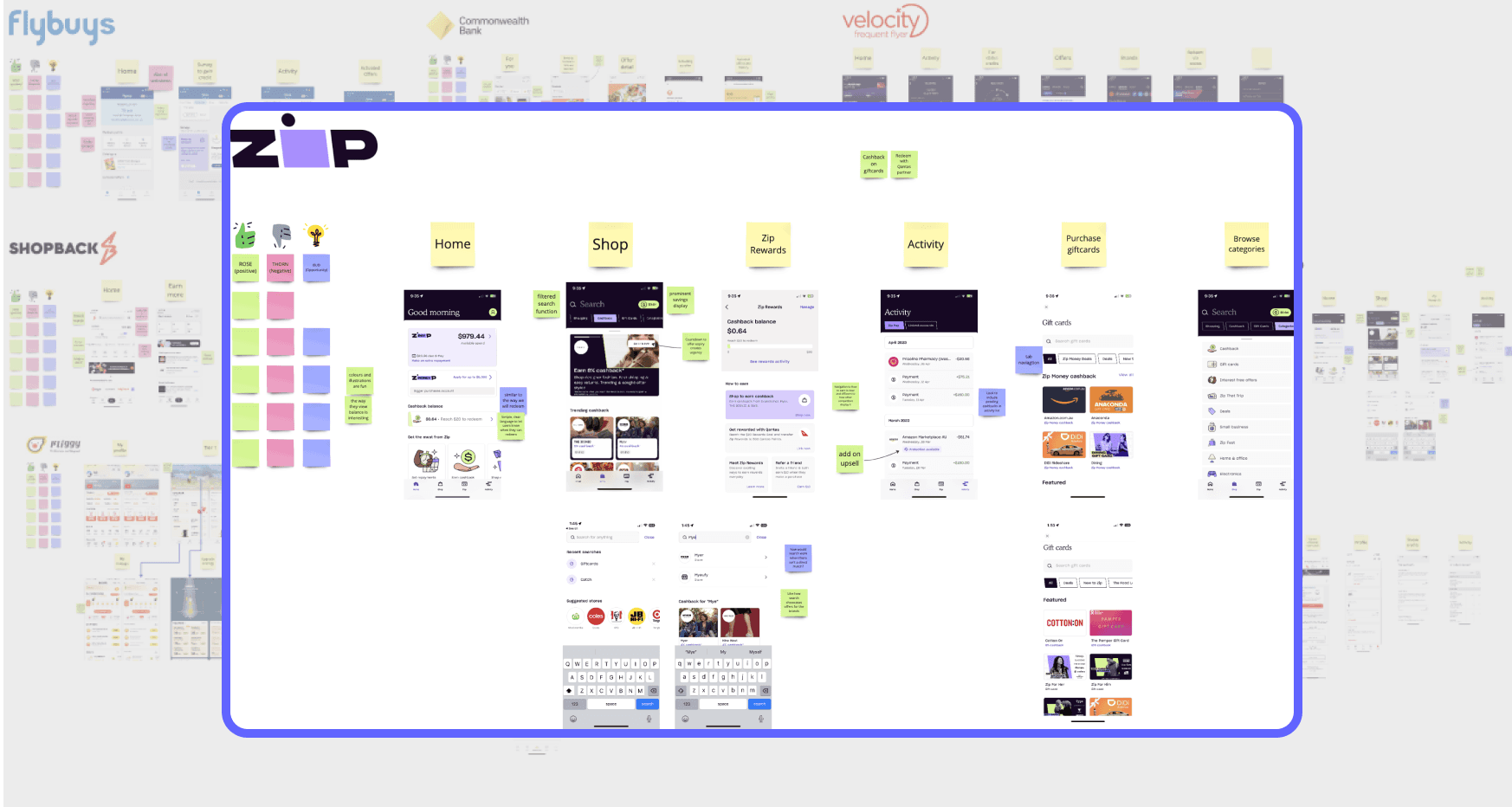

Competitor analysis

03

ANALYSIS

User persona & user journey

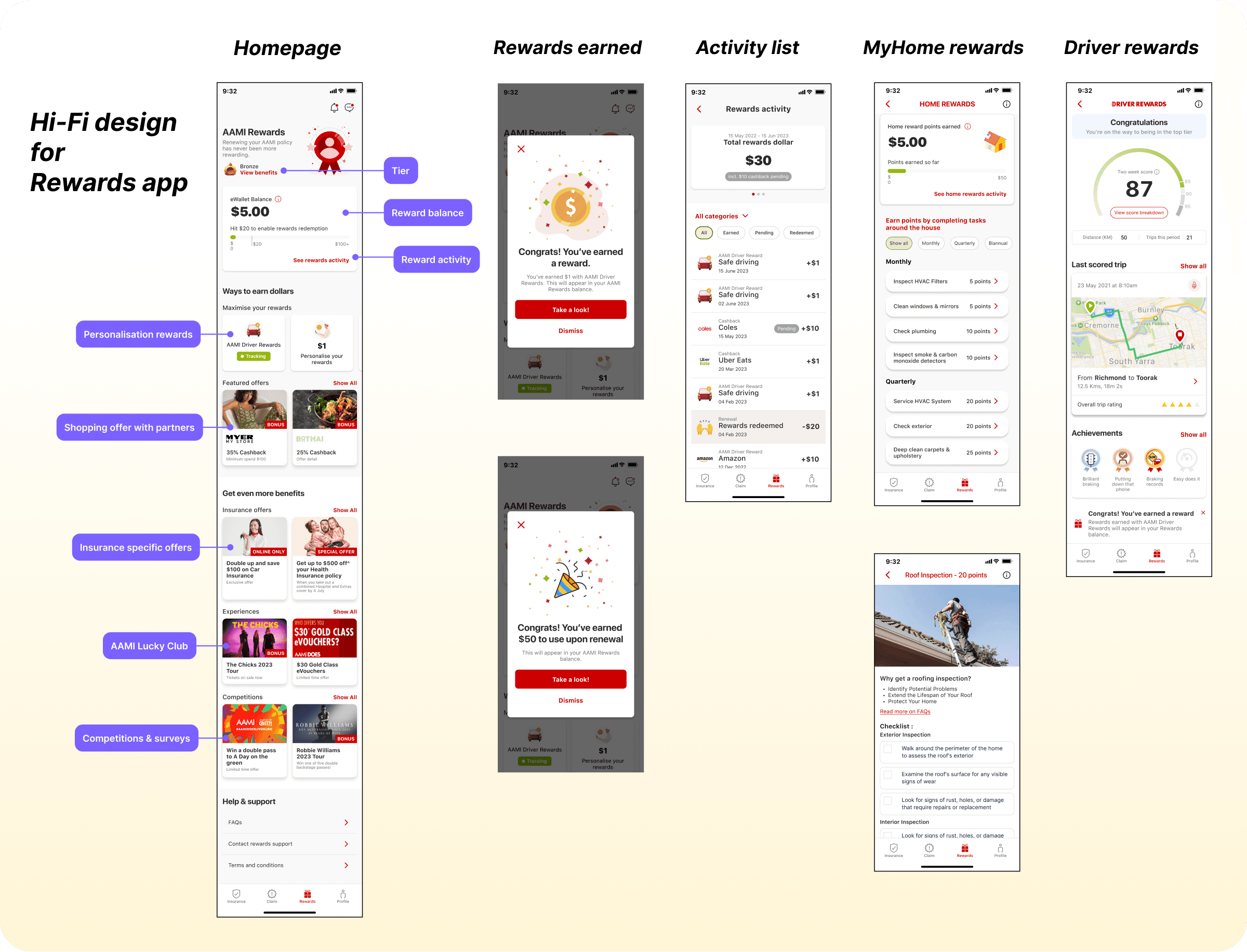

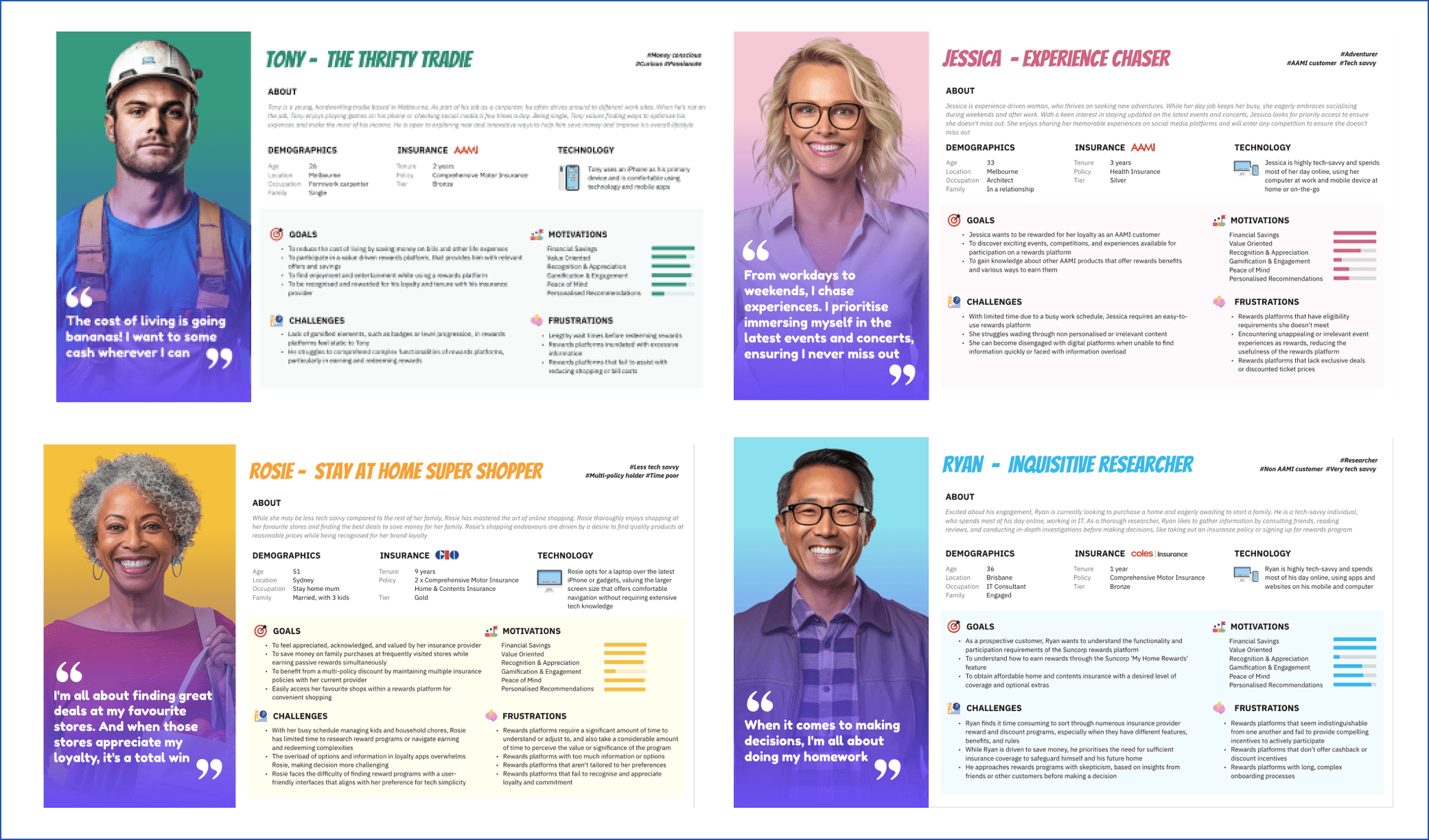

We developed 4 different personas to represent different group of audience and identify different needs for the program. :

- an existing car insurance product holder

- new customers who purchased home insurance

- customer is interested in live concerts

- customer who likes to save money when shopping groceries

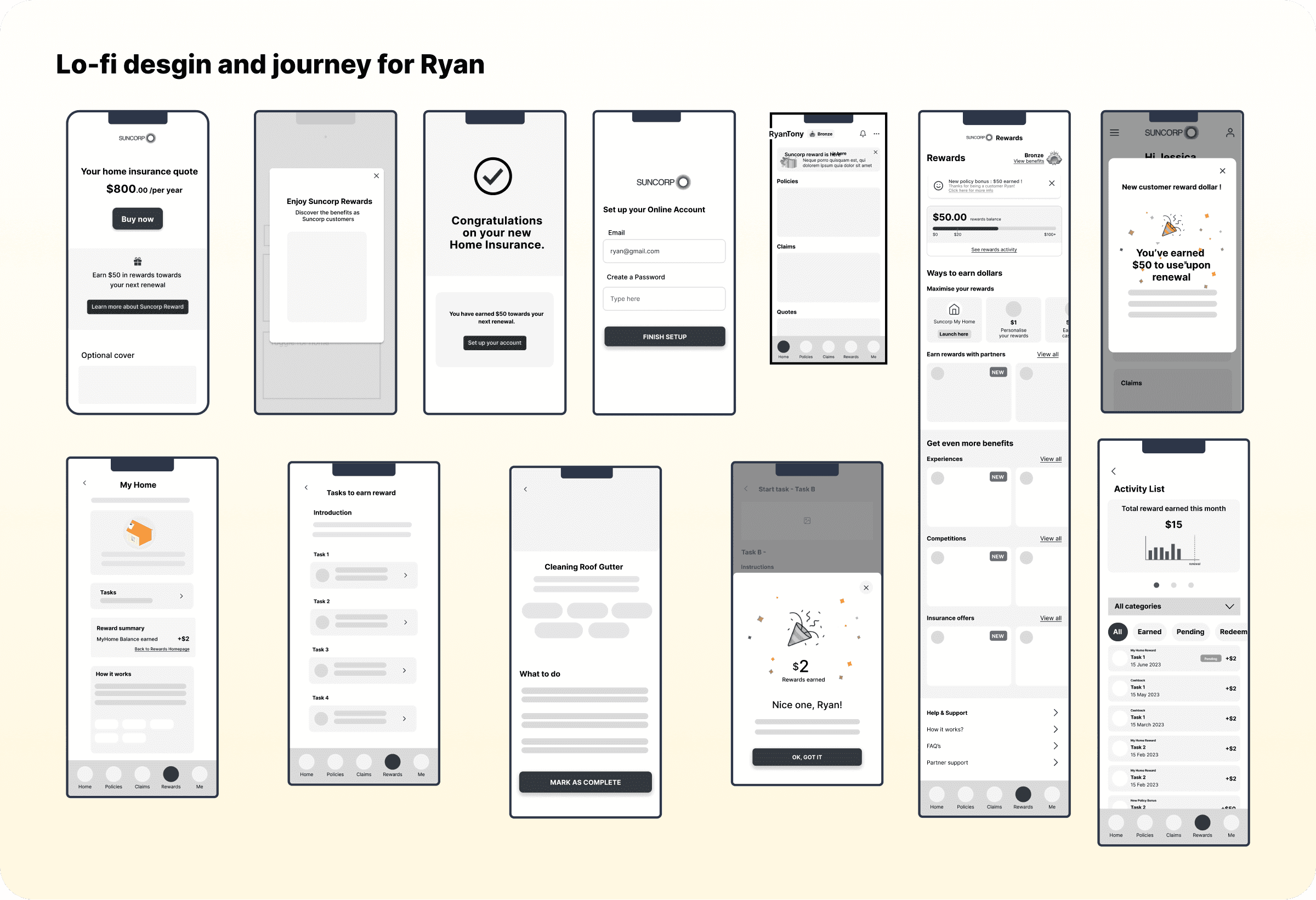

My persona was Ryan, who is in the journey of purchasing a new home insurance with Suncorp. He would like to understand how to earn rewards through ‘MyHome rewards’ feature. He is incentivised to complete tasks in the program if it helps reduce his premium during renewals. He is also entice by the options provided to save on his policy price.

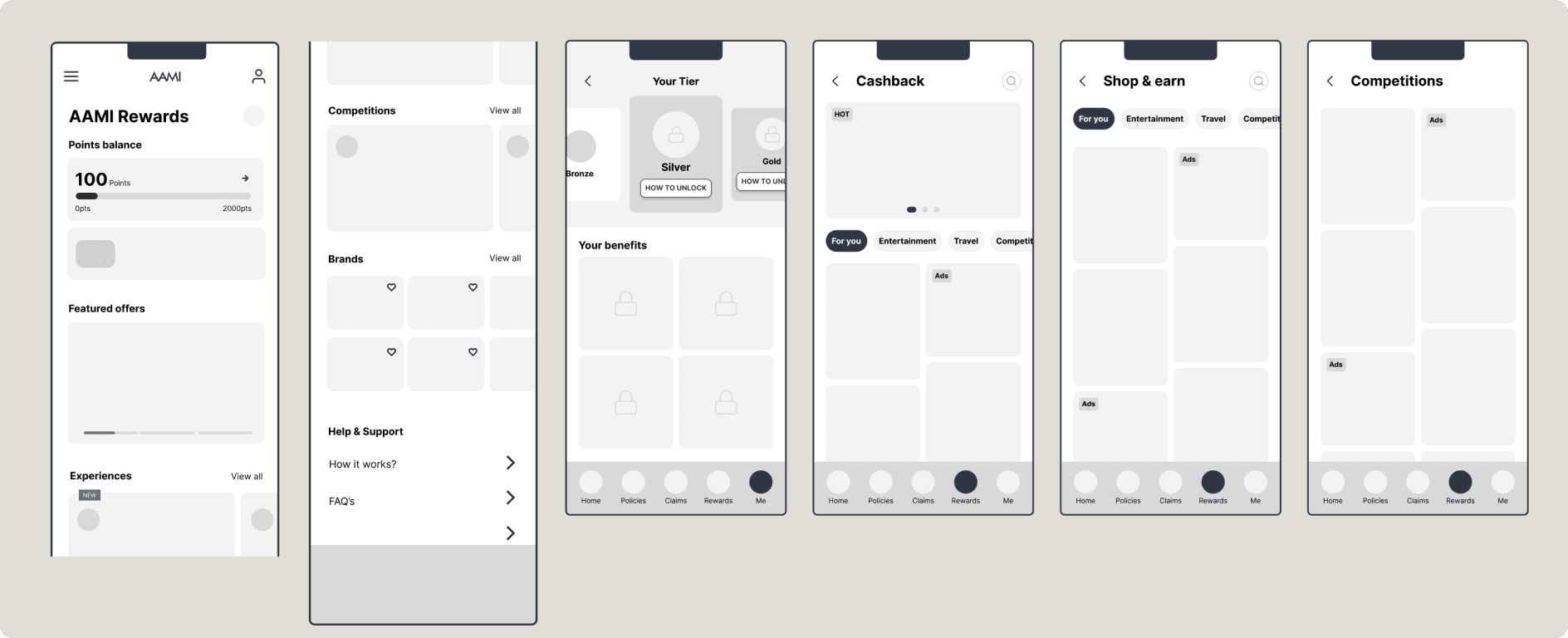

After validating our user personas with stakeholders, we created wireframes and designed 4 different user journeys.

Ryan's user journey -

The journey for Ryan is to successfully purchase home insurance and be a new customer as he is incentivised by the $50 new customer offer.

He would then register and activate his account.

He can now access to the Rewards section.From there, he would see that he has earned his $50.

He starts a new task for MyHome Reward to earn his first activity reward money. He would be notified of the completion of task.

Ryan can also track his rewards activity in the Activity List.

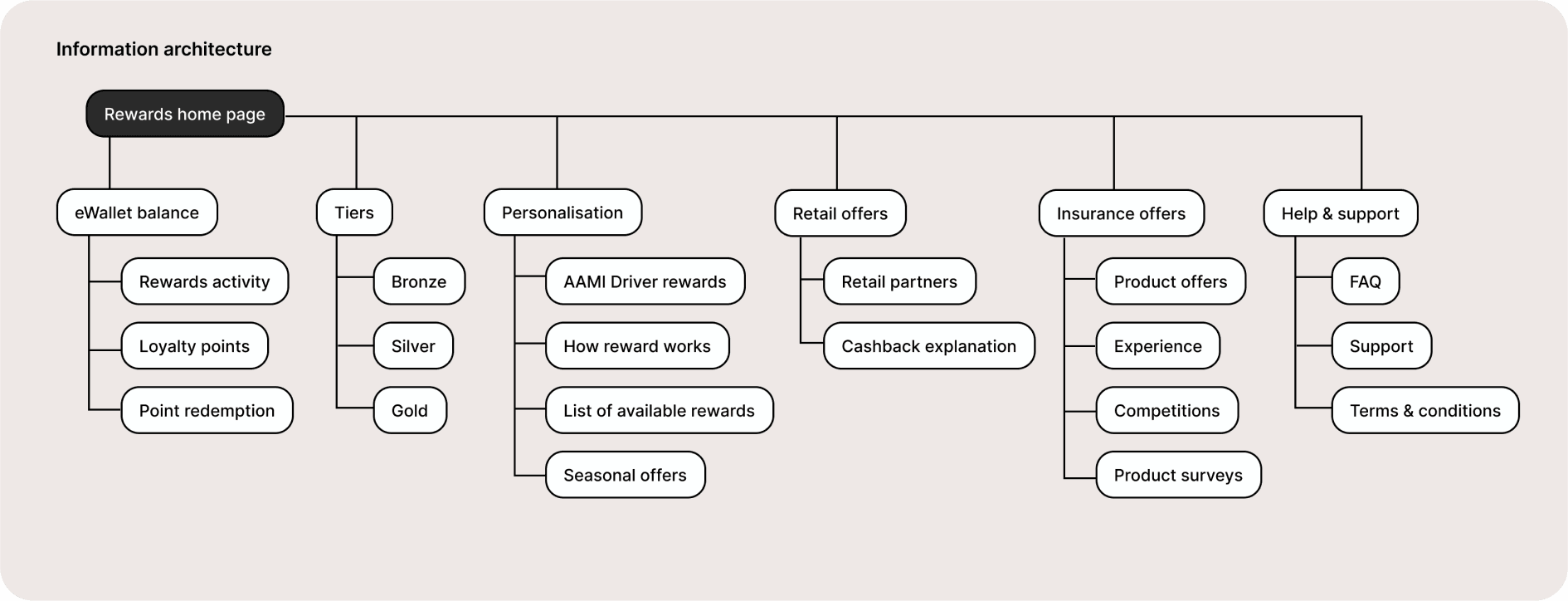

Information architecture

We created information architecture so that we could label and give structure to pieces of information and content. It helps to define the content and functionality that could exist in the app.

Design considerations

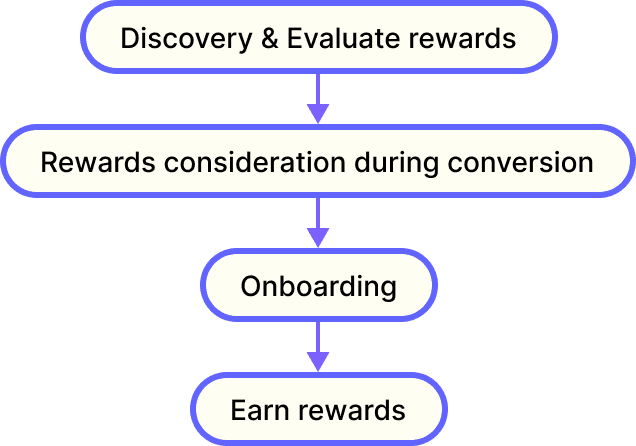

For each stages of rewards journey, we had considerations from both customer and business perspectives. We wanted to outline these questions to address some potential problems that might arise when developing the vision for Loyalty Program.

Discovery & evaluate rewards

what is the point of difference for the program ?

How will prospective customers / customers find out about the program?

What level of detail is needed to evaluate an offer?

What do customers expect from an insurance company rewards program?

Rewards consideration during conversion

When is the right moment in the flow to promote the program?

Is the reward program a strong enough proof of point for prospective customers ?

How easy is it to find info on eligibility criteria?

Onboarding

What would make an easy onboarding experience?

What is the best form of comms to educate customers on how the rewards platform work?

How do we onboard current policy holders vs new customers ?

Earning rewards

How do we communicate different task wait times?

What are the success metrics for the program

How often should users engage with the program to be considered a success ?

What is the cost per renewal for business?

04

DESIGN & DELIVERY